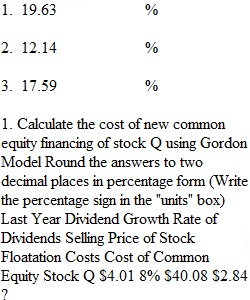

Q 1. Calculate the cost of new common equity financing of stock Q using Gordon Model Round the answers to two decimal places in percentage form (Write the percentage sign in the "units" box) Last Year Dividend Growth Rate of Dividends Selling Price of Stock Floatation Costs Cost of Common Equity Stock Q $4.01 8% $40.08 $2.84 ? 2.Last year the Black Water Inc. paid dividends $4.82. Company’s dividends are expected to grow at an annual rate of 5% forever. The company’s common stock is currently selling on the market for $74.35. The investments banker will charge flotation costs $3.45 per share. Calculate the cost of common equity financing using Gordon Model. Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box). 3.Paul Sharp is CFO of Fast Rocket Inc. He tries to determine the cost of equity financing for his company. The stock has a beta of 2.45. Paul estimated that the market return is 9.32%. The current rate for 10-year Treasury Bonds is 3.62%. Calculate cost of common equity financing using CAPM – SML formula. Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box) 4.Nature Food Inc. needs to estimate the cost of financing on preferred stock. The firm has preferred stock outstanding that pays a constant dividend of $4.57 per year. That preferred stock is currently selling for $83.53. However, the underwriter would charge flotation costs of $3.96 per share. What is the form’s cost of preferred stock financing? Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box) 5.The Yo-Yo Corporation tries to determine the appropriate cost for retained earnings to be used in capital budgeting analysis. The firm’s beta is 1.10. The rate on six-month T-bills is 3.51%, and the return on the S&P 500 index is 7.72%. What is the appropriate cost for retained earnings in determining the firm’s cost of capital? Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box).

View Related Questions